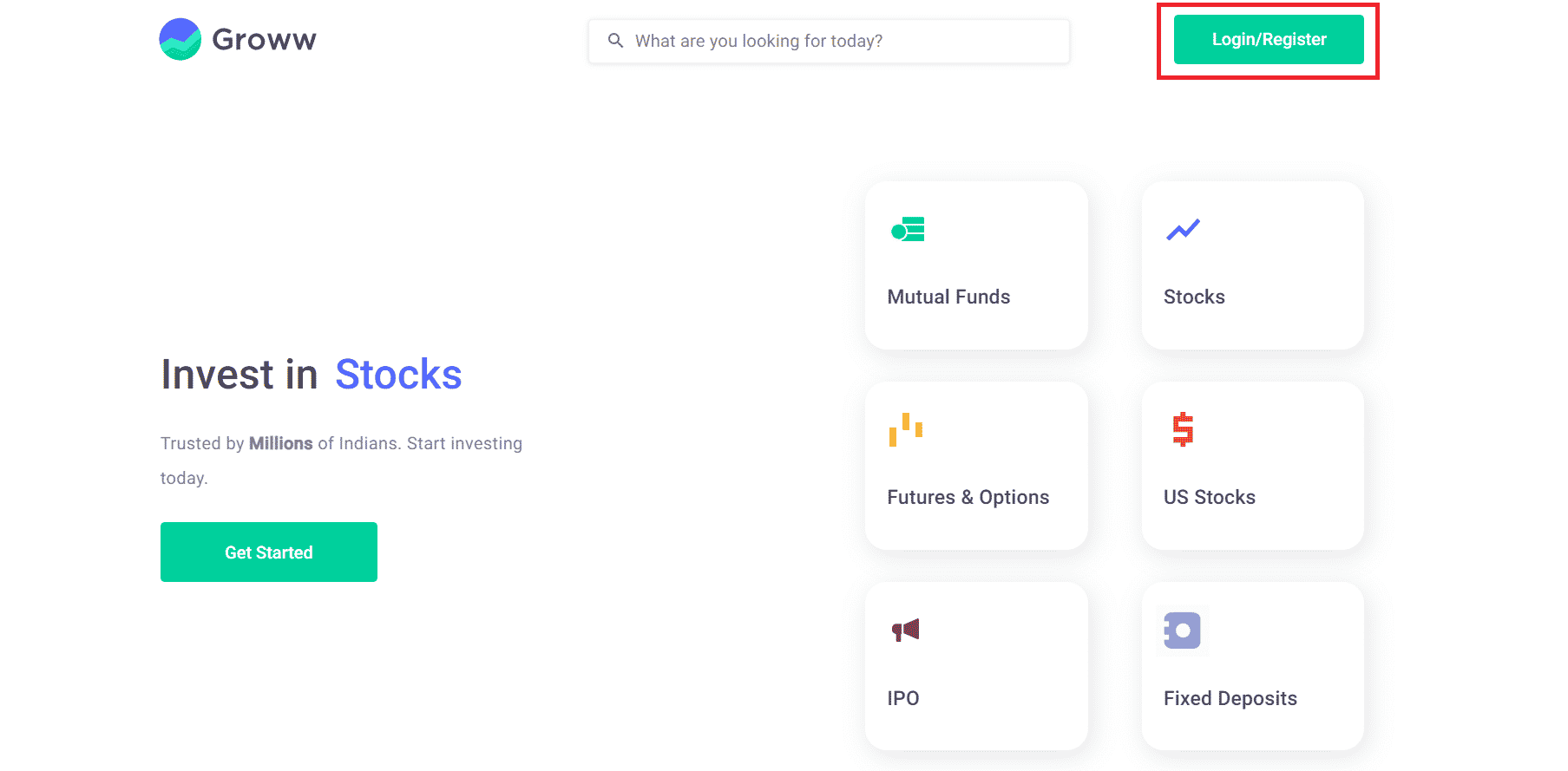

Open Groww Demat Account

Groww Demat Account Information.

Open Demat Account Click Here.

Groww is an Indian online investment platform that allows users to invest in mutual funds, stocks, and other financial instruments. To use Groww's services, you will need to open a demat account with them.

A demat account, short for "dematerialized account," is an electronic account used to hold securities like stocks, bonds, and mutual funds. It eliminates the need for physical share certificates, making it easier to buy and sell securities.

To open a demat account with Groww, you can follow these steps:

- Visit the Groww website or download the Groww app.

- Click on the "Sign Up" or "Create Account" button and enter your mobile number.

- Enter the OTP (one-time password) sent to your mobile number to verify your identity.

- Provide your PAN (Permanent Account Number) and other personal details like your name, date of birth, and email address.

- Set up a password and security questions to secure your account.

- Complete the KYC (Know Your Customer) process by submitting your Aadhaar card, PAN card, and a passport-size photograph.

- Once your KYC is verified, you can start investing in mutual funds and stocks through your Groww demat account.

It's important to note that Groww charges a fee for its services, including opening and maintaining a demat account. You should also research the risks and benefits of investing in various financial instruments before making any investments.

Open Demat Account Click Here.

1. Types of Demat Accounts: Groww offers two types of demat accounts, namely Basic Services Demat Account (BSDA) and Regular Demat Account. The BSDA is for investors who hold a maximum of Rs. 50,000 worth of securities in their account, and it has lower fees compared to the Regular Demat Account.

2. Demat Account Charges: Groww charges an account opening fee of Rs. 200 for its demat account services. They also charge an annual maintenance fee (AMC) of Rs. 300 for Regular Demat Accounts and Rs. 100 for BSDA accounts. Other charges include transaction charges, custodian fees, and depository participant charges.

3. Investment Options: With a Groww demat account, you can invest in a variety of financial instruments, including mutual funds, stocks, exchange-traded funds (ETFs), and bonds.

4. Online Investment Platform: Groww is an online investment platform that allows you to invest in various financial instruments using its website or mobile app. You can track your portfolio performance, view investment recommendations, and make investments online.

5. KYC Process: To open a demat account with Groww, you will need to complete the KYC process, which involves providing your PAN card, Aadhaar card, and a passport-size photograph. You can complete the KYC process online by submitting the necessary documents and completing an in-person verification (IPV) via video call.

6. Benefits of Demat Account: A demat account offers several benefits, such as eliminating the risk of physical share certificates getting lost, stolen or damaged. It also allows for quick and easy transfer of securities, reduces paperwork, and provides a secure way to hold your investments.

7. Trading Platform: In addition to providing an online investment platform, Groww also offers a trading platform where you can buy and sell stocks in real-time. The trading platform is easy to use and provides features like real-time market data, advanced charting tools, and customized watchlists.

8. Research and Analysis: Groww provides research and analysis tools to help investors make informed investment decisions. The platform offers news updates, expert recommendations, and investment insights to help you stay informed about market trends and investment opportunities.

9. SIP Investments: Groww's demat account allows you to set up Systematic Investment Plans (SIPs) for mutual funds. This allows you to invest in mutual funds at regular intervals and build a diversified portfolio over time.

10. Education Resources: Groww provides education resources to help investors learn about investing and financial planning. The platform offers articles, videos, and tutorials on a variety of topics, including personal finance, investing, and taxation.

11. Customer Support: Groww offers customer support via phone, email, and chat. They also have a comprehensive FAQ section on their website to help investors find answers to common questions.

12. Partnered with Trusted Brokers: Groww has partnered with trusted brokers to provide demat account services. This ensures that your investments are held securely and you have access to a wide range of financial instruments.

Open Demat Account Click Here.

In conclusion, opening a demat account with Groww can be a convenient and secure way to invest in various financial instruments. However, it's important to understand the risks involved and do your research before making any investment decisions.

No comments: